PHOTO

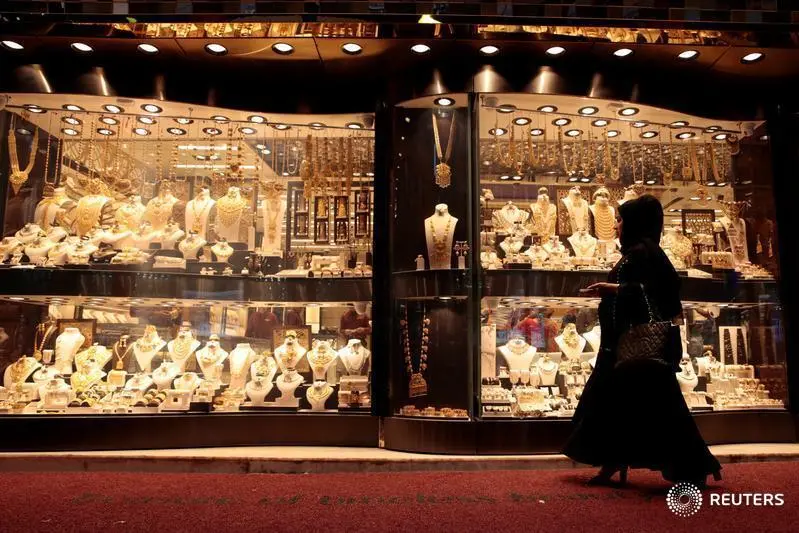

UAE residents are rushing to buy gold after the yellow metal slumped to a nine-month low.

On Tuesday evening, the precious metal was trading at $1,680 a troy ounce, down 23 per cent from the high of $2,072 in August last year.

In the UAE, gold was trading at Dh205.75 per gram.

“We are witnessing a significant increase in customer footfalls in the past few days as customers are increasingly buying gold, taking advantage of the recent dip in gold price and keeping the price movements in mind,” said Shamlal Ahamed, Managing Director — International Operations, Malabar Gold & Diamonds.

Joyalukkas, another big retailer in Dubai, shares the same view. “There has been good off-take and customers see the current price levels as very attractive and hence the right time to buy. Gold is one of the best investment options and considering the prevailing low-price level people should also look at gold from an investment perspective that will give decent returns in the long run,” said John Paul Alukkas, Managing Director, Joyalukkas Jewellery — International Operations. “A considerable amount of customers are still interested in buying gold bars from an investment perspective, however the major demand is still in jewellery,” added Alukkas.

There has been a big rise in demand for the precious metal mostly among Indians and Chinese who are top consumers of gold in the world. A visit to some gold retailers in Meena Bazaar shows most of the customers buying jewellery or bullion are Indians. “Growing up I had seen my mother investing money in gold, and it has given her good returns. This year, I also started investing in gold through monthly contributions. At the end of the year, I plan to buy jewellery,” said Geetika Arora, a customer service executive based in Dubai.

The price of gold is higher in India and China than the global market and is nearing its pre-pandemic levels because of continued buying interest.

“The positive growth combined with gold being the only consumable investment has attracted young Millennials who are mostly first-time buyers, among whom there is a significant demand for lightweight and multi-use jewellery — jewellery which can be used on multiple occasions and are subtle and sophisticated,” added Ahamed.

Gold losing lustre as safe haven?

Uncertainty in economic environment supports assets like gold. However, with the global economy recovering, equity markets staying buoyant, and rising interest in cryptocurrencies, the safe haven appeal of gold is losing lustre and leading to a fall in its value. “Gold prices are suffering in 2021 as investors move out of haven assets (like gold and government bonds) into riskier markets like equities. While the global economy is still very much dealing with the economic consequences of the Covid-19 pandemic, the fact that vaccines are being deployed and there is more clarity on eventual management of Covid-19 means that haven assets don’t hold as much appeal as ones that would be geared to improvement in the global economy. A stronger US dollar is also acting as a drag on gold prices this year,” said Edward Bell, Senior Director, Market Economics, Emirates NBD.

The trend is expected to continue for most of this year. “We expect that gold prices are going to fall in 2021. They can spend considerable time below $1,700/troy oz for much of the second half of 2021,” added Bell.

Globally, investors are paring holdings in this asset class. Gold-backed exchange traded funds (ETFs) are witnessing continued outflows. Gold ETFs reflect the value of gold and are traded on exchanges just like company stocks, eliminating the need for safekeeping of the precious metal, while still assuring its inclusion in one’s portfolio. Data on the World Gold Council website suggests ETFs have suffered an outflow of 224.9 tonnes in the last year.

The yellow metal is also facing stiff competition from cryptocurrencies that are emerging as a new asset class that acts as a hedge against inflation. The market cap of cryptocurrencies is nearing $2 trillion on the back of increased interest.

Copyright © 2021 Khaleej Times. All Rights Reserved. Provided by SyndiGate Media Inc. (Syndigate.info).