PHOTO

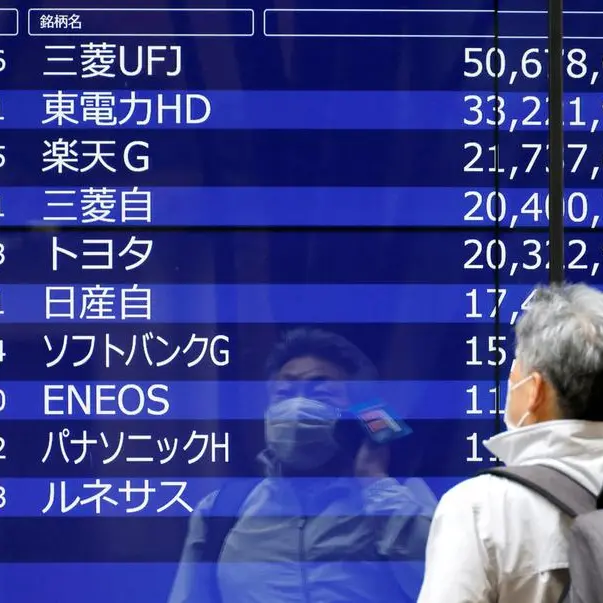

- Asian shares rise despite an overnight drop on Wall Street

- Oil prices drop on weak demand outlook

- Abu Dhabi’s index gains 0.4 percent as FAB surges

- Dollar drops, gold gains

Global markets

Asian shares rose in early trading on Thursday after the United States Federal Reserve abandoned plans to raise interest rates this year.

In comments at the end of a two-day policy meeting Wednesday, the Fed abandoned projections for any interest rate hikes this year amid signs of an economic slowdown, and said it would halt the steady winding down of its balance sheet in September, according to a Reuters report.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.5 percent on Thursday morning.

Overnight on Wall Street, the Dow Jones Industrial Average fell 0.55 percent to 25,745.67 and the S&P 500 declined 0.29 percent to 2,824.23, but the Nasdaq Composite edged up by less than 0.1 percent to 7,728.97.

Oil prices

Oil prices edged lower again on Thursday on concerns over weak demand, despite a report from the U.S. that showed a decline in crude oil stockpiles.

U.S. West Texas Intermediate (WTI) crude futures were at $60.16 per barrel at 0040 GMT, down 7 cents, or 0.1 percent, from their last settlement. WTI had earlier hit a high of $60.19 a barrel - the highest since November 12.

International Brent crude oil futures were at $68.47 a barrel, down 3 cents from their last close. Brent touched $68.57 a barrel on Wednesday, its highest since November 13.

The Energy Information Administration said on Wednesday that U.S. crude oil stockpiles last week fell by nearly 10 million barrels, the most since July, boosted by strong export and refining demand.

Stockpiles fell by 9.6 million barrels, compared with analysts’ expectations for an increase of 309,000 barrels. The draw brought stockpiles to their lowest level since January.

Middle East markets

Saudi Arabia’s index edged 0.2 percent lower on Thursday after Saudi Basic Industries slipped 0.3 percent and Riyad Bank shed 1.5 percent as the lender traded ex-dividend.

The Abu Dhabi index was up 0.4 percent, with First Abu Dhabi Bank and Emirates Telecommunications, Etisalat, each gaining 0.8 percent. Etisalat announced after the market closed that its shareholders approved a dividend payment of 80 fils per share at the company’s annual general meeting.

In Dubai, the index edged up 0.1 percent. Emirates Integrated Telecommunications and Commercial Bank of Dubai jumped by 2.9 percent 2.7 percent respectively.

The Qatari index was up 0.2 percent as six of its seven banks rose, with the Middle East's biggest, Qatar National Bank, gaining 1.1 percent.

Egypt’s blue-chip index EGX30 rose 0.5 percent, Kuwait’s premier market index added 1.2 percent while Bahrain’s index edged 0.2 percent higher and Oman’s index added 0.1 percent.

Currencies

The dollar dropped early on Thursday in Asian markets, as investors turned to equities.

It fell 0.6 percent overnight against the yen, its biggest drop since January, to trade at 110.67 yen.

Precious metals

Gold prices rose on a weakening dollar.

Spot gold gained 0.3 percent at $1,315.81 per ounce as of 0114 GMT.

U.S. gold futures rose 1.1 percent to $1,316.10 an ounce.

(Reporting by Gerard Aoun; Editing by Michael Fahy)

(gerard.aoun@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019