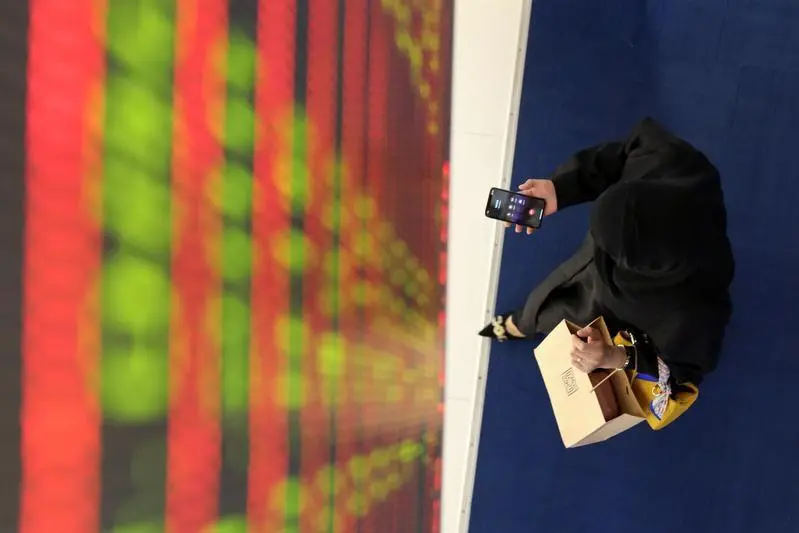

PHOTO

The overall outlook for UAE stocks in 2020 remains positive based on attractive valuations and potential medium-term catalysts, Marwan Haddad, Senior Portfolio Manager at Emirates NBD Asset Management told Zawya.

“In an effort to maximize efficiency, amidst a weaker macro environment, banks, GREs and other corporates, both in Dubai and Abu Dhabi, engaged in commendable aggressive consolidation and restructuring,” Haddad said.

National Bank of Abu Dhabi and First Gulf Bank merged back in 2017 to create the UAE’s largest bank First Abu Dhabi Bank. In 2018, Abu Dhabi’s Aldar Properties acquired $1 billion worth of real estate assets from the state-owned Tourism Development & Investment Company (TDIC). In January 2019, Abu Dhabi Commercial Bank and Union National Bank announced that they agreed to merge and for the combined entity to acquire Al Hilal Bank, creating the third largest bank in the UAE behind First Abu Dhabi Bank and Emirates NBD.

“While this resulted in some near-term pain, we believe the outcome of much more efficient institutions and recent massive economic reforms will result in a pick-up in economic activity, all of which should support growth in the coming 2 to 3 years,” he added.

The UAE government has implemented many programmes aimed at enhancing business opportunities for investors, providing conducive environment for established businesses and attracting human capital.

For example, the country relaxed company ownership rules to allow 100 percent foreign ownership in specific industries including banking in a move that should boost foreign direct investments (FDI).

Haddad believes the inflection point could be EXPO 2020 Dubai, as it is expected to support sectors such as hospitality and tourism across the country.

“At the initial stage, we expect the banking sector to perform better which should also be supported by passive flows for the likes of Emirates NBD and Abu Dhabi Islamic Bank (which have among the most attractive valuations),” Haddad said.

Emirates NBD’s stock has added 36.5 percent from the start of 2019 until the end of November, while Abu Dhabi Islamic bank rose 31 percent during the 11 months period.

“The real estate recovery is expected in 2021 to 2022 as the market absorbs the existing demand supply imbalance. Nevertheless, market leaders such as Emaar Development should perform better on the back of a strong pipeline (market share reached 70-75% in 2019), strong cash flows, attractive valuations and the highest dividend yield in the region,” Haddad added.

Emaar Development’s stock dropped 18.4 percent during the 11 months period.

Banking sector looks healthy but not without challenges.

“Abu Dhabi Commercial Bank is expected to perform well as it starts to extract synergies from the merger and finalize the Purchase Price Accounting (PPA) provisions by the first quarter of 2020,” Haddad said.

“For the banking sector, while we believe net interest margins will be manageable given the recent interest rate cuts, we expect cost-to-income ratios to trend lower due to aggressive costs cuts which took place in 2019,” Haddad said.

“That being said, while provision coverage is healthy, asset quality should be a major area of concern and needs to be continuously monitored especially if economic activity does not pick up,” he ended.

(Writing by Gerard Aoun; editing by Seban Scaria)

(gerard.aoun@refinitiv.com)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019