PHOTO

Qatar's index fell on Wednesday as it witnessed heavy selling from local and GCC investors, while Saudi Arabia inched up, partly lifted by corporate results.

The Qatar index fell 1.2 percent, with 16 of its 20 stocks dropping.

Blue-chips Qatar Insurance slid 6 percent and Qatar Islamic Bank was down 2 percent.

The Qatar exchange, which jumped 21 percent in 2018, was one of the world's best-performing markets for the year, after limits were lifted on foreign ownership of shares.

But the index has experienced a spate of selling this month, with investors looking to allocate money to other regional markets that offer better valuations and short term catalysts.

The index was pressured by selling from Qatari and GCC shareholders in this session, despite buying from non-Qatari investors, according to data on the stock exchange.

Saudi Arabia's index inched up 0.2 percent, with Leejam Sports 1830.SE rising 6.2 percent to end as the top gainer. The company posted higher full-year net profit and sales.

Travel services provider Al Tayyar changed course to add 3.6 percent despite reporting a loss for the year, following a 421 million-riyal loss on the disposal of its investments.

Arqaam Capital maintained its "buy" rating on Al Tayyar, saying it sees value in the firm's 14.7 percent stake in ride-hailing service Careem.

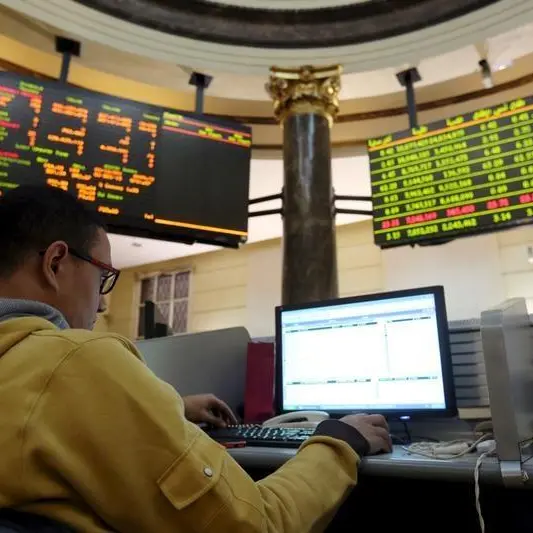

The Egyptian blue-chip index lost 0.8 percent, pulled down by financial stocks.

Commercial International Bank, the stock with the largest weight on the index, declined for the fifth straight day, falling 1.8 percent.

Ezz Steel Co was down 3.2 percent. Arqaam Capital said it expects another quarter of losses to the tune of 646 million Egyptian pounds ($36.94 million) in the fourth-quarter as margins are weighed down by subdued prices.

Palm Hill Development decreased 2.5 percent. The firm reported a drop in its full-year standalone net profit and revenue.

The Dubai index shed 0.3 percent, with four of its six property stocks falling.

Emaar Development was down 3.8 percent and developer Deyaar DEYR.DU lost 3.5 percent.

Emaar Malls, which bought 49 percent of e-commerce fashion website Namshi from Global Fashion Group for 475.5 million dirhams, dropped 1.1 percent.

Dubai's index, which was one of the world's worst performing markets last year, has risen 5.8 percent this year, mainly because of strong fourth-quarter earnings at real estate companies.

Abu Dhabi's index rose 0.2 percent, with Dana Gas climbing 3.4 percent and First Abu Dhabi, the biggest lender in the United Arab Emirates, adding 0.7 percent.

First Abu Dhabi's shareholders approved the increase of its foreign ownership limit to 40 percent from 25 percent on Tuesday.

($1 = 17.4900 Egyptian pounds)

(Reporting by Abinaya Vijayaraghavan in Bengaluru Editing by Frances Kerry) ((abinaya.vijayaraghavan@thomsonreuters.com; within U.S.+1 646 223 8780; outside U.S. +91 80 6749 2733; Reuters Messaging: abinaya.vijayaraghavan.thomsonreuters.com@reuters.net))