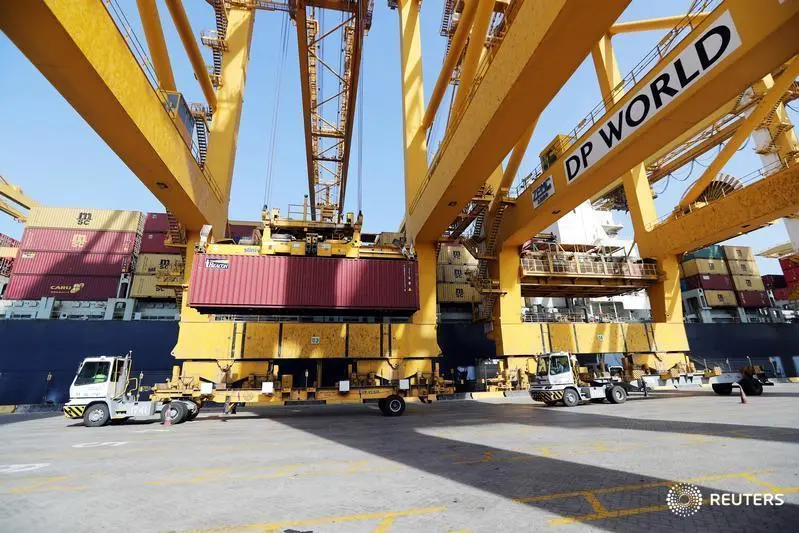

PHOTO

DUBAI: Dubai's DP World is set to raise $1 billion in bonds equally split between sukuk, or Islamic bonds, and conventional notes, a document issued by one of the banks leading the deal showed.

The $500 million 10-year sukuk offers a profit rate of 3.75%, while the 30-year conventional paper offers a 4.7% yield.

The port operator, majority owned by the government, received orders in excess of $2.9 billion for the issuance, the document said.

(Reporting by Davide Barbuscia; Editing by Susan Fenton) ((Davide.Barbuscia@thomsonreuters.com; +971522604297; Reuters Messaging: davide.barbuscia.reuters.com@reuters.net))