PHOTO

Global investment banking fees reached $115.8 billion during the first nine months of 2021, posting a 21 percent rise compared to the first nine months of 2020 and the strongest opening nine-month period for global IB fees since records began in 2000, according to global data provider Refinitiv.

Fees during the third quarter of 2021 totalled $35.3 billion, a 12 percent decline from the second quarter of this year.

The Americas contributed 53 percent of all fees generated globally, at $61.7 billion, a 28 percent uptick compared to 2020 levels. Imputed fees in the EMEA region increased 22 percent to $26 billion during the first nine months of 2021, driven by year-over-year gains in the UK and France. Total IB fees in Asia-Pacific and Japan hit $28.1 billion with a 7 percent uptick compared to 2020.

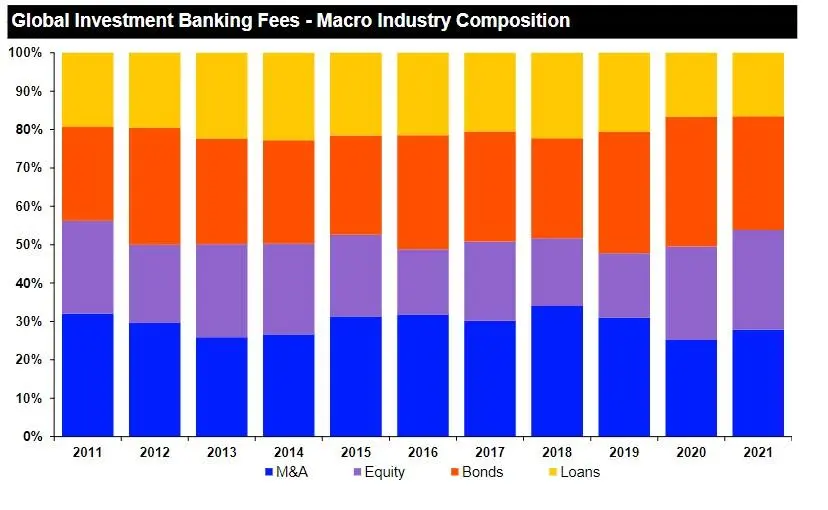

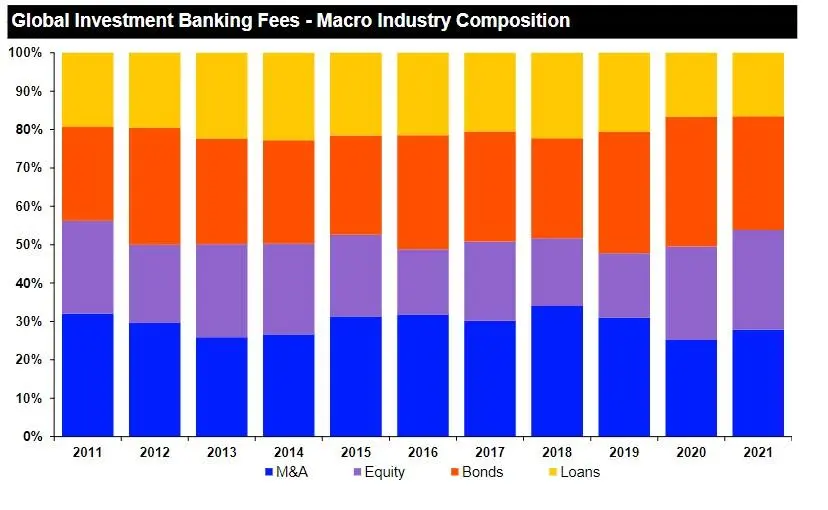

Powered by record IPO issuance (including SPACs), equity capital market (ECM) underwriting fees totalled a record $30.1 billion during the first nine months of 2021, a 36 percent increase compared to 2020 levels, Refinitiv said in its quarterly report.

However, despite a record level of high yield corporate bond offerings, debt capital market (DCM) underwriting fees was down by 4 percent compared to the first nine months of 2020.

Completed M&A advisory fees registered a 44 percent uptick compared to a year ago with $32.2 billion in fees globally, the strongest first nine months since records began in 2000. Syndicated lending activity reached a record $19.2 billion, a 21 percent increase compared to the first nine months of 2020.

While most sectors registered gains, fees from global financials-related activity led all other sectors with $36.3 billion, up 38 percent compared last year and accounting for 31 percent of all fees globally.

According to available data with Refinitiv, the Tech and Financial sectors registered the strongest double-digit percentage increases compared to a year ago, while Media & Entertainment and Government/Agency sector fees both fell 5 percent compared to the first nine months of 2020.

JP Morgan held the top spot for investment banking fees with $9.6 billion. Goldman Sachs remained in second place with an estimated 7.5 percent of global wallet share and Morgan Stanley took the third spot with $6.7 billion in fees.

(Writing by Seban Scaria seban.scaria@refinitiv.com; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021