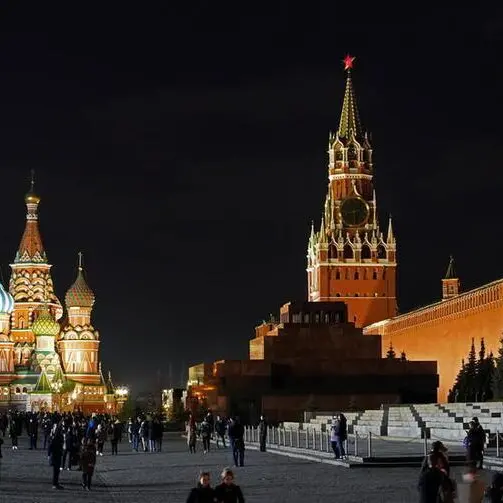

PHOTO

Russian stock indexes rose on Wednesday, shrugging off threats of new Western sanctions in response to what Moscow calls "a special military operation" in Ukraine, while the rouble firmed to stand below 90 to the euro.

Equities largely lost ground at the market open on reports that the United States and its allies had prepared new sanctions on Moscow that will target Russian banks and officials and ban new investment in Russia.

An EU official said the European Union will also have to introduce measures against imports of Russian oil and even gas at some point as a way to pressure Moscow.

The dollar-denominated RTS index fell to 979.34 points before paring losses and adding 2.6% on the day to 1,031.3 points by 1219 GMT.

The rouble-based MOEX Russian index gained 0.5% to 2,675.5, still trading far from an all-time high of 4,292.68 reached in October.

Downside pressure on shares emanating from negative sentiment around news on Western sanctions could be limited as the government has promised to support Russian companies by buying their stocks with money channelled from the rainy-day National Wealth Fund.

The Russian stock market is showing "miraculous resilience" to possible new sanctions and a rapid drop in activity in the domestic manufacturing and services sectors in the absence of foreign investors that are still barred from taking part in trading in Russia, Finam brokerage said in a note.

Shares in oil producer Lukoil climbed 2.8%, outperforming the broader market. Its peer Gazprom Neft added 1.9%.

Banks were in the red, with the two major state-owned lenders Sberbank and VTB losing 1.8% and 2.4%, respectively.

The Russian rouble firmed, shrugging off a potential default on Russia's international debt as the country paid dollar bondholders in roubles and said it would continue to do so as long as its foreign exchange reserves are blocked by sanctions.

The rouble added nearly 2% on the day to 81.70 to the dollar. It strengthened 2.7% to trade at 89.10 versus the euro, near levels seen before Russia sent tens of thousands of troops into Ukraine on Feb. 24.

Weekly inflation data will be in focus later in the day. If inflation shows signs of slowing, it may raise chances of a rate cut by the central bank at its next board meeting in late April. The latter could be positive for OFZ treasury bonds.

"At the same time, geopolitical risks and rouble volatility limit the probability of this scenario," Promsvyazbank said in a note.

(Reporting by Reuters; editing by Uttaresh.V, Kirsten Donovan)