PHOTO

Cairo - JLL, the world's leading real estate investment and advisory firm, has released its fourth quarter (Q4 2014) Cairo Real Estate Market Overview report, which provides the consultancy's perspective on the latest trends in the office, residential, retail and hotel sectors in the market.

Commenting on the report, Ayman Sami, Head of Egypt Office at JLL MENA, said: "In the second half of 2014, Cairo's real estate market showed signs of strengthening in the residential market and stability in the commercial sector due to new projects announced recently. Cairo's office landscape expansion will increase the total stock across Greater Cairo and rents will be stable across all the commercial locations. Developers are now able to progress with stalled projects, and the high level of delays witnessed in recent years is therefore likely to decline. As confidence returns and the Ministry of Tourism continues to promote a number of mega investments across the country, 2015 could see major new hospitality projects announced in Cairo."

Sector summary highlights, Cairo Market Overview, Q4 2014:

Office: Cairo's office performance remained relatively unchanged over the last quarter of 2014, with rents stable across all the commercial locations monitored by JLL. The major completion in Q4 was a further 14,000 sq m in Mivida (New Cairo). An additional 52,000 sq m is expected to be delivered in 2015, of which 31,000 sq m are due for delivery in Q1. This will increase the total stock across Greater Cairo to 955,000 sq m. Despite an increase in enquiries for commercial space, vacancy levels increased to 35% in the basket of buildings monitored by JLL at the end of 2014, as an additional 85,000 sq m was added to the current stock during the past year.

Residential: Cairo's residential market continues to recover with improved sales figures. Apartment and villa sale prices increased during 2014 across all sectors monitored by JLL.. Similarly, the rental market has registered annual growth levels in most locations. Over the past quarter, the strongest growth has been recorded in villa prices in 6th October (up 9%) and apartment rents in New Cairo (up 7%). The positive political and economic outlook is expected to drive investments in the residential sector, particularly in prime property, thus strengthening the market further in 2015.

Retail: The Cairo retail market remained stable in Q4 2014, with average prime retail rents static at between USD 720 - USD 1,416 sq m and average line store rents unchanged at USD 1,170 sq m. Demand has been relatively active over the quarter, particularly from the food and beverage segment, thus decreasing vacancy rates to 19% (compared to 23% in Q3). This trend is expected to continue into the future as market sentiment improves and demand continues to increase, reflecting positively on rental rates.

Hotel: Q4 saw delays in the handover of the Nile Ritz Carlton (331 keys), increasing the total expected supply in 2015 to 623 keys. While YT November occupancy rates remain lower than they were in 2013 (44% versus 49% respectively), ADR's have improved significantly (78%) to register USD 105 YT November 2014. This reflects government initiatives to increase room rates on the back of scrapping fuel subsidies.

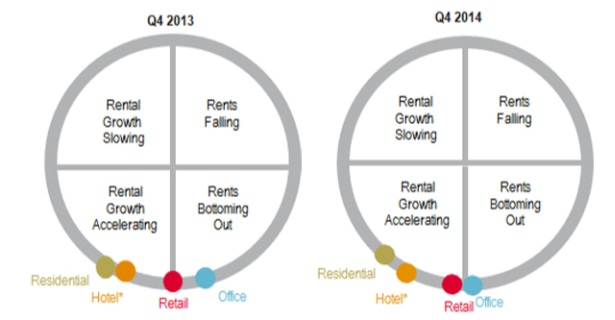

Cairo prime rental clock

This diagram illustrates where JLL estimate each prime market is within its individual rental cycle as at the end of the relevant quarter.

Contact:

Ayman Sami / Kathryn Athreya

Phone:+202 2480 1946/+971 4 426 6999

Email:ayman.sami@eu.jll.com / kathryn.athreya@eu.jll.com

Erica Pettit / Vadia Rai

+971 4 437 2105 / +971 4 437 2110

erica.pettit@fticonsulting.com /vadia.rai@fticonsulting.com

Ref:JLL_Cairo Q4 2014

About JLL

JLL (NYSE: JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. With annual fee revenue of $4.0 billion and gross revenue of $4.5 billion, JLL has more than 200 corporate offices, operates in 75 countries and has a global workforce of approximately 53,000. On behalf of its clients, the firm provides management and real estate outsourcing services for a property portfolio of 3.0 billion square feet, or 280 million square meters, and completed $99 billion in sales, acquisitions and finance transactions in 2013. Its investment management business, LaSalle Investment Management, has $50 billion of real estate assets under management. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated.

About JLL MENA

Since its establishment in the Middle East, JLL has become a leading player in the region's real estate markets, building upon its local and global experience and expertise. Across the Middle East, North and Sub-Saharan Africa, JLL is a leading player in the real estate market and hospitality services market. The firm has worked in 40 Middle Eastern and African countries and has advised clients on more than US$ 1 trillion worth of real estate, hospitality and infrastructure developments. JLL employs over 180 internationally qualified real estate, hospitality and other professionals of 30 nationalities with regional offices in Dubai, Abu Dhabi, Riyadh, Jeddah and Cairo. Combined with the neighbouring offices in Casablanca, Istanbul and Johannesburg, the firm employs more than 450 staff and provides comprehensive services in the wider Middle East and African (MEA) region.

Office 86, 8th Floor│ Star Capital 2│Cairo, Egypt │Tel: +202 2480 1946 Fax: +202 2480 1950 www.jll-mena.com

© Press Release 2015